The Hidden Ways Payroll Providers and Teams Help

- September 5, 2023

- Posted by: Hannah Ingram

- Category: Pay, Reward & Benefits

Payroll Providers and Team Skillsets

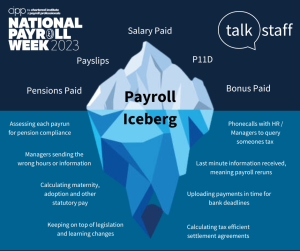

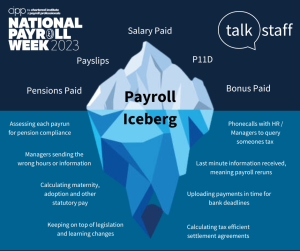

Today, we’re celebrating the hidden ways payroll providers and teams support your people including your in-house teams. What do you think of first when it comes to payroll?

You think of payslips, basic pensions and bonuses, or perhaps a P11D; but there’s a lot more going on behind the scenes too.

Payroll providers have some incredible skillsets from their impressive attention to detail and formidable time management to their continuous learning that keeps them, and you, on top of the ever-changing legislation.

Here’s 5 ways payroll providers and teams and outsourced payroll specialists are working behind the scenes:

-

Keeping Payroll Compliant

Protecting you against errors

Getting payroll right is essential for compliance and employee satisfaction. Payroll errors can hugely damage your company’s reputation and break trust with both employees and stakeholders.

Admin errors – Payroll professionals often deal with admin errors. These can be sent across from managers or other departments looking to tick payroll tasks off their lists quickly or not having the right knowledge to carry out admin effectively.

Payroll teams can help mentor these managers and departments to reduce these errors by introducing robust processes.

Last minute requests – Payroll can have added complexities including working patterns and time sheets, and last-minute payroll reruns are often part of the job.

HR Crossover – Payroll professionals may also need to work closely with HR departments, for example to identify tax fraud; something which can have lasting consequences for individuals and your business if these aren’t picked up quickly.

Attention to detail – Payroll professionals often have incredible attention to detail and their ability to spot errors quickly, and process these in a speedy manner, are an underrated skill.

2. Owning Statutory Pay

Getting your people through important life events

Statutory pay often happens when your people are going through a life event. From becoming parents to experiencing ill health – Statutory Sick Pay (SSP). Getting an accurate pay check allows them to focus on what’s happening in their lives rather than the added pressure of checking paperwork.

Payroll providers also deal with additional pay types, including complex furlough payments, adoption & and paternity pay and associated declarations to HMRC.

Processing Pensions– Protecting your employee’s future

Pensions are an essential part of the payroll process because they significantly impact your people’s future.

Employers are responsible for ensuring that any pension contributions deducted from earnings, after 6th April 2018, are at least equal to the minimum amounts laid down by the legislation.

Payroll professionals ensure pensions are compliant, dealing with:

Auto enrolment pensions – When an employee who meets certain requirements is made a member of a workplace pension scheme without having to ask to join.

Pay rises – Including counteroffers

Eligible worker status – Ensuring they are the right age to enter the scheme and other factors

New joiners – Onboarding and enrolment payment tasks

3. Keeping on top of legislation as payroll providers

Keeping you compliant and in the know

Staying on top of legislation is a top skillset for payroll teams. It’s imperative your business remains compliant and continuous learning and development to stay on top of the ever-changing legislation is paramount.

Changes can be announced in the Autumn and Spring budgets such as in National Minimum Wage as well as other changes throughout the year. Payroll teams experience more frequent changes than most departments.

The stakes are high for getting this right which means learning and development is a key part of the role as well as passing on important information to the leadership team.

4. Hitting Payroll Deadlines

Using time management to keep your business running efficiently

Payroll professionals are busy bees as pay day approaches. They may be handling queries from external customers as well as your own team, all balanced against their day-to-day tasks making time management a strong skillet for them.

5. Calculating tax efficient settlement agreements

Settlement agreements make a difficult time easier for employees who are leaving.

Settlement agreements usually include a tax indemnity clause, however in some cases employees can qualify for a specific tax exemption.

Supporting your payroll teams

And getting the most out of them for the business

Payroll teams experience a rollercoaster ride during the month with intense periods when they are extremely busy. You can support them in several ways:

Ease the pressure by ensuring processes minimise human error, this also helps prevent errors slipping through the net.

Where possible avoid other tasks that may land out their desk that could be avoided including department creep (HR tasks for example).

Encourage an open culture where payroll team members can discuss their mental health, burnout or concerns over work-life balance; rested teammates are more productivity and you’re more likely to retain your top payroll talent.

Allow them the right time within working hours to carry out the learning and development needed to support themselves and the organisation in terms of keeping up-to-date with legislation. They can then keep you in the loop too.

Exploring outsourced payroll services?

We’ve written an article to help you choose an outsourced payroll provider if you are looking to bring in external outsourced payroll services, exploring the pros and cons of such a move.

We support organisations directly with outsourced payroll services and fully managed payroll.

In addition, we also work alongside businesses with inhouse payroll teams on everything from hiring qualified roles and wellbeing sessions.

We’re always happy to have a conversation to help you explore your payroll options and how to support your existing team too.

Last Updated on 11 months by Hannah Ingram